“Taxes are the price we pay for a civilized society.” This quote by Oliver Wendell Holmes Jr. is the motto of Canadians for Tax Fairness, an organization that “advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities and funding quality public services.”

“Taxes are the price we pay for a civilized society.” This quote by Oliver Wendell Holmes Jr. is the motto of Canadians for Tax Fairness, an organization that “advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities and funding quality public services.”

The group has released a set of recommendations entitled Platform for Tax Fairness to help parties include tax fairness measures in their election platforms. The document is well worth a read. I found a number of the recommendations particularly appealing. For instance,

• Eliminating the corporate stock option (Read more…) deduction. Among other things, the deduction encourages executives to use corporate funds to engage in stock buybacks. This is precisely what happened in the U.S. with the Trump tax cuts.

• Eliminating the lower tax rate on capital gains. This is one of the country’s major loopholes, and clearly unfair to working people who have to pay taxes on their full incomes.

• Restoring the corporate tax rate to that of a decade ago. It has been cut in half in the last two decades.

• Applying the GST and HST to imports of digital services from foreign internet giants, taxing them for the business they do in Canada, and eliminating the business deductions for advertising expenses on foreign internet platforms.

• Reforming the international tax system by applying “formulary apportionment” i.e. allocating the taxable income of corporations between countries using a formula based on real economic factors, primarily sales and employment payroll expenses. This is a system that has worked well in this country for apportioning taxes between provinces.

• Publishing how much taxes large corporation actually pay in taxes.

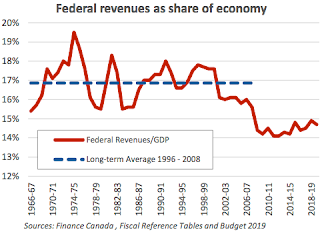

This is a small sampling of the proposed platform. Tax Fairness claims that the recommendations would generate over $40-billion annually in additional revenues for the federal government. As the graph at the upper right indicates, federal revenues have shrunk from an average of almost 17 per cent of GDP to less than 15 per cent in this century. That two per cent drop represents $50-billion, enough to fund affordable child care for all, a national universal pharmacare plan, affordable housing and a variety of environmental measures.

Canadians for Tax Fairness can be found here, where you’ll find the proposed platform and an opportunity to subscribe to their excellent newsletter.